Catch Up Limits 2025

Catch Up Limits 2025. The board of control for cricket in india (bcci) has unveiled a partial schedule for the upcoming season, comprising 21 matches slated from march 22 to april 7. 403 (b) contribution limits are $22,500 in 2023, and $23,000 in 2025.

For individuals under 50, the standard 401 (k) contribution limit in 2025 23,000. That’s an increase of $500 over.

Give The Market And Supply Chains A Chance To Catch Up.

See how the contribution limits have changed.

For 2025, The Ira Contribution Limits Are $7,000 For Those Under Age 50 And $8,000 For Those Age 50 Or Older.

The general limit on total employer and employee contributions for 2023 was $66,000.

The Limit On Employer And Employee Contributions Is $69,000.

Images References :

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, Give the market and supply chains a chance to catch up. The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Source: sandboxfp.com

Source: sandboxfp.com

2023 Contribution Limits for Retirement Plans — Sandbox Financial Partners, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. See how much you can save in your 403 (b).

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, That would be a huge increase over current ev sales, which rose to 7.6% of new vehicle sales last year, up from 5.8% in 2022. It is playing catch up.

Source: www.carboncollective.co

Source: www.carboncollective.co

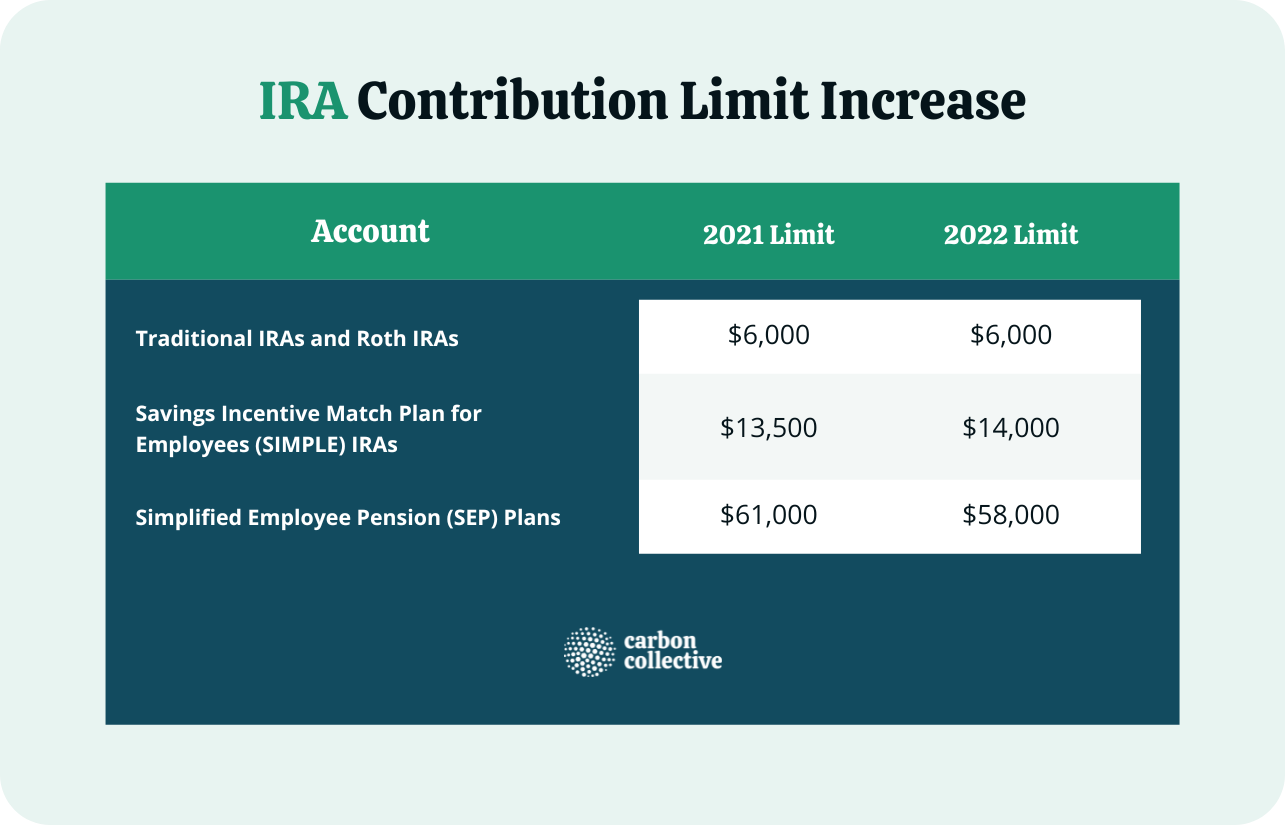

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, For 2025, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older. The annual contribution limit for traditional and roth iras for 2025 is $7,000.

Source: www.dhkn.ie

Source: www.dhkn.ie

Time,To,Catch,Up,Motivation,Message,On,Concept,Clock,For, The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older. The 401 (k) compensation limit is $345,000.

Source: imagesee.biz

Source: imagesee.biz

Tabela Atualizado Irs 2023 Hsa Limit IMAGESEE, For individuals under 50, the standard 401 (k) contribution limit in 2025 23,000. See how the contribution limits have changed.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, It is playing catch up. For individuals under 50, the standard 401 (k) contribution limit in 2025 23,000.

Source: choosegoldira.com

Source: choosegoldira.com

self directed 401k contribution limits 2022 Choosing Your Gold IRA, The general limit on total employer and employee contributions for 2023 was $66,000. 401(k) contribution limits for 2025 the 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, For 2025, this limitation is increased to $53,000, up from $50,000. Irs releases the qualified retirement plan limitations for 2025:

Source: w2023gw.blogspot.com

Source: w2023gw.blogspot.com

2023 Roth Ira Limits W2023G, For 2025, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older. Individual retirement accounts, or iras, can help you save and invest for retirement.

Irs Releases The Qualified Retirement Plan Limitations For 2025:

401(a) plans the total contribution limit for 401(a) defined contribution plans under section 415(c)(1)(a) increased from $66,000 to $69,000 for 2025.

That Means People Over 50 Can Contribute Up To $30,500 To These Retirement Plans.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.