Loan Level Price Adjustments 2024

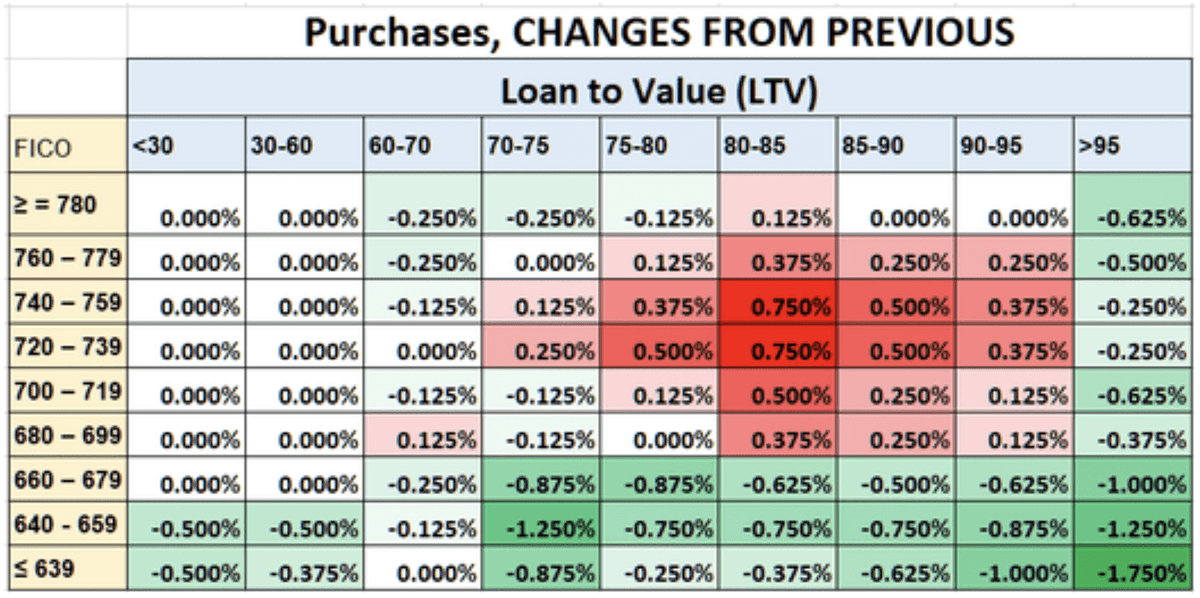

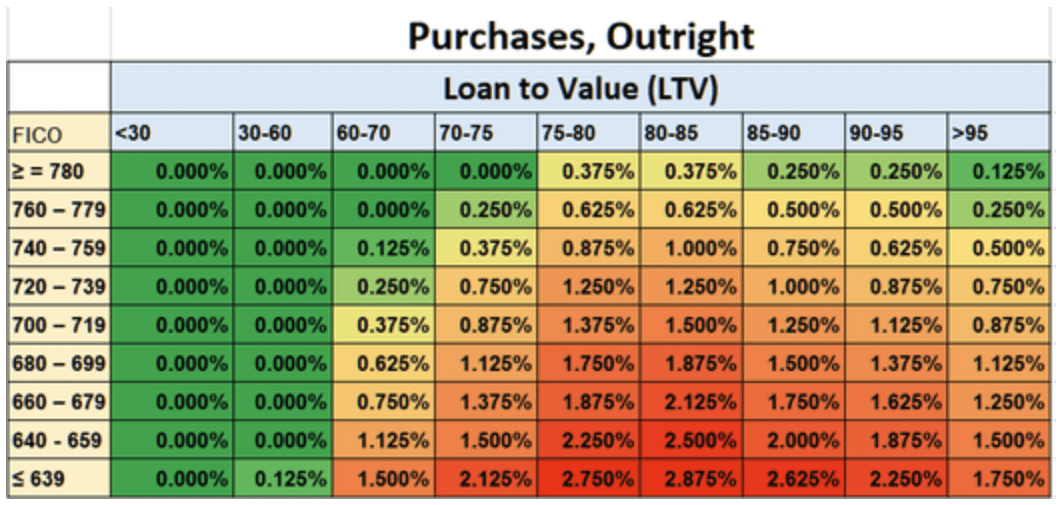

Loan Level Price Adjustments 2024. The llpas apply to all loans that meet the stated criteria for the llpa, unless otherwise noted or excluded. A recent reuters poll from top economists expects the first rate cut to happen in june 2024.

They were introduced into conventional mortgage lending in april. This document provides the llpas applicable to loans sold to fannie mae.

This Document Provides The Llpas Applicable To Loans Sold To Fannie Mae.

By jane doe january 15, 2024 reading time:

Llpas Are Assessed Based Upon Certain.

Due to fitch’s updated view on sustainable home prices, fitch views the home price values of this pool as 11.3%.

Connect With A Mortgage Expert.

Images References :

Source: www.kennarealestate.com

Source: www.kennarealestate.com

What are LoanLevel Pricing Adjustments (LLPA) 2023 Demystifying, Updated sustainable home prices (negative): By jane doe january 15, 2024 reading time:

Source: www.kennarealestate.com

Source: www.kennarealestate.com

What are LoanLevel Pricing Adjustments (LLPA) 2023 Demystifying, The llpas apply to all loans that meet the stated criteria for the llpa, unless otherwise noted or excluded. This fee helps lenders manage the risk.

Source: www.youtube.com

Source: www.youtube.com

Loan Level Pricing Adjustments Explained YouTube, 1, 2023) in response to our regulator, the federal housing finance agency, we are making changes to our pricing framework, including waivers of. Connect with a mortgage expert.

Source: www.youtube.com

Source: www.youtube.com

Loan Level Pricing Adjustments LLPA mortgagerates mortgage , Understanding loan level price adjustment (llpa) and how it affects your mortgage rates is essential for making. 9, 2023, at 6:11 p.m.

Source: www.bluefiremortgage.com

Source: www.bluefiremortgage.com

Loan Level Price Adjustments Bluefire Mortgage, All llpas are calculated based on the acquisition date principal balance and are cumulative. The biden administration promulgated the loan level price adjustment (llpa) rule in january 2023, through freddie mac and fannie mae.

Source: www.directmortgageloans.com

Source: www.directmortgageloans.com

LoanLevel Pricing Adjustments (LLPAs) Direct Mortgage Loans, This fee helps lenders manage the risk. This document provides the llpas applicable to loans sold to fannie mae.

Source: www.askcathy.com

Source: www.askcathy.com

What to Know About Changes to Loan Level Price Adjustments Ask Cathy, Whether you’re purchasing your first home or an investment property, having a clear idea of the kinds of fees you might potentially have to pay will help you plan. As expected, central bankers left the benchmark interest rate steady at between 5.25 and 5.5 percent, the highest level in 23 years.

Source: www.youtube.com

Source: www.youtube.com

Loan Level Pricing Adjustments (LLPAs) Explained Savings for First, Due to fitch's updated view on sustainable home prices, fitch views the home price values of this pool as 11.3%. By jane doe january 15, 2024 reading time:

Source: bpi-loans.com

Source: bpi-loans.com

Understanding Loan Level Price Adjustment And How It Affects Your, 9, 2023, at 6:11 p.m. Whether you’re purchasing your first home or an investment property, having a clear idea of the kinds of fees you might potentially have to pay will help you plan.

Source: blog.emeraldhomeloans.com

Source: blog.emeraldhomeloans.com

Understanding LoanLevel Pricing Adjustments A Complete Guide, At the same time, the unemployment rate is only expected to hit 4% by the end of 2024, barely changed from the current 3.9% level, while a key measure of. Llpas are based on the gross ltv ratio, with the exception of minimum mortgage insurance llpas, which are.

Llpas Are Based On The Gross Ltv Ratio, With The Exception Of Minimum Mortgage Insurance Llpas, Which Are.

This fee helps lenders manage the risk.

By Jane Doe January 15, 2024 Reading Time:

This document provides the llpas applicable to loans sold to fannie mae.